Mortgage and Financial Companies in the Denver Metro Area

Find Trusted, Local Home Pros “Near Me”!

Since 2009, Team Dave Logan has helped millions of Colorado homeowners connect with background-checked, local contractors—no personal data required.

Find a Financial ProfessionalThe Team Dave Logan Difference

Our Pros are Vetted and Screened Annually*

- Secretary of State

- Comprehensive Criminal Database Search (US, State, County)

- Patriot Act/OFAC/BXA/Terrorist List Search

- Business and Personal Credit Report

- Civil Lawsuit Search

- Due Diligence Analysis

- License Verification**

- Limited Liability Insurance

- Malpractice Insurance

- Minimum One Year in Business

Although we hold our companies to a high standard, you are encouraged to do your own due diligence before hiring one of our pros to work with you, as everyone’s needs and requirements are different.

Why Hire a TDL Pro?

- Local, Background-Checked Pros

- No Personal Data Required to Search

- Serving Colorado Homeowners Since 2009

- Millions of Homeowners Helped

- Local Warranty Service

- Emergency 24-hour Coverage

Services | Mortgage and Financial

Trusted Pros

Add your zip code to find Team Dave Logan contractors that serve your area.

Select a subcategory to further refine your results and find specific services.

Reviews from Actual Denver Homeowners

“Team Dave Logan is my go-to for finding contractors of all types. They do a through check of all companies including insurance, giving me confidence that people they recommend are capable and upstanding. I've also received discounts from contractors on the order of $500-$1,000 for using Team Dave Logan, and they have all provided excellent service.”

“Team Dave Logan is the gold standard when it comes to connecting homeowners with reputable, trustworthy professionals. Their vetting process is thorough, and it really shows—every company we’ve worked with through their network has been top-notch. It's clear they truly care about quality and integrity. Whether you're a homeowner looking for reliable help or a contractor looking to align with a reputable brand, Team Dave Logan delivers. Highly recommend!”

“Very pleased with my experience with Team Dave Logan. They have proven to be a valuable resource to choose in confidence in a very scary industry. Highly recommend!”

Financial Professional Services

Our Financial Professional Pros offer the following services:

Find Trusted Mortgage Lenders in Denver, Colorado

Buying a home is one of the biggest financial steps most people take in their lives. Whether you're purchasing your first house, refinancing your current one, or exploring options for an investment property, the right mortgage guidance can make a big difference.

At Team Dave Logan, we connect homeowners and buyers in Denver and surrounding areas with mortgage and financial services that match their goals. You’ll find loan experts who can walk you through every step, from pre-approval to closing, with a focus on clear communication, competitive mortgage solutions, and personalized support. Every company we work with is reviewed annually to help ensure you're working with professionals you can trust.

Mortgage and Financial Services Our Pros Provide

FHA Loans: FHA loans are often a great choice for first-time homebuyers or anyone who may not have a large down payment. These government-backed loans help make homeownership more accessible, especially if you're still building credit or saving for a new home.

VA Loans: If you're a veteran or active-duty service member, VA loans offer a powerful advantage. With no down payment required in most cases and competitive interest rates, this loan option honors your service by making it easier to buy or refinance a home.

Refinance: Whether you're looking to lower your monthly payment, lock in a better rate, or tap into your home's equity, refinancing can be a smart move. A mortgage professional can help you decide if it’s the right time based on today’s mortgage rates and your financial goals.

Specialty Loans: From jumbo loans to renovation financing and investment property loans, specialty loan options help meet specific needs. These are especially useful when standard loan programs don’t quite fit your situation.

Adjustable-Rate Mortgages (ARMs): ARMs offer a lower initial interest rate that adjusts over time. If you’re planning to move or refinance within a few years, this flexible loan structure might help you save more in the short term.

Home Equity Lines of Credit (HELOCs): A HELOC lets you borrow against your home’s equity for things like renovations, emergency funds, or paying off high-interest debt. It’s a flexible way to access cash while keeping your long-term finances on track.

Why Homeowners in Colorado Choose

Our Mortgage Professionals

- Guidance through every step: From pre-approval to final paperwork, you'll get help understanding the loan process, monthly payments, and how to avoid common hiccups during your homeownership journey.

- Locally focused service: These loan experts know the housing market in Denver, Colorado Springs, and surrounding areas, and how to help you compete in a busy market.

- Screened professionals only: Every mortgage and financial services company in our network is screened annually for licensing, customer satisfaction, and professional conduct.

- Real loan options that fit real budgets: Whether you're buying your dream home or refinancing your current property, you’ll get access to loan options that match your income, credit score, and timeline.

- Clear answers and smart tools: You’ll get real answers about interest rates, down payments, and the full cost of buying or refinancing, without all the jargon.

How to Choose the Right Mortgage and Financial Company

There are plenty of companies offering mortgage support, but not all provide the same level of care or clarity. Here are a few things to look for when making your decision:

Licensed and local: Look for lenders who are familiar with your area and fully licensed to operate in Colorado.

Transparent about fees and interest rates: A reputable mortgage expert will break down every cost, so there are no surprises later.

Strong communication: You should feel informed and supported from the first call through closing day.

Options tailored to your needs: Whether you're buying, refinancing, or investing, the right loan should be based on your goals and financial picture, not a one-size-fits-all plan.

Verified experience: Customer reviews, testimonials, and years in business help show that a company stands behind its services.

Ready to Explore Your Mortgage Options?

Whether you’re buying your first home, refinancing to save money, or tapping into your home's equity for something new, Team Dave Logan can help you find a mortgage partner who puts your needs first.

All the mortgage professionals in our network are screened annually for licensing, experience, and customer reviews, so you can feel confident you're working with someone who has your best interest in mind.

Why Trust Our Mortgage and Financial Companies

At Team Dave Logan, we connect discerning homeowners with pre-screened contractors known for superior craftsmanship, reliability, and professionalism. Each pro in our network has earned our trust through proven performance so you can hire confidently, no guesswork required.

FAQs

How do I know which loan option is right for me?

The best loan depends on your financial situation, credit score, and how long you plan to stay in the home. A licensed mortgage expert can walk you through loan options like FHA, VA, and ARMs to help you find the best fit.

What's the benefit of getting pre-approved?

Pre-approval gives you a clear picture of what you can afford and shows sellers you're a serious buyer. It also helps speed up the homebuying process once you find the right home.

Can I refinance if my credit isn’t perfect?

Yes, depending on the type of loan and how much equity you have. Some refinance options are available even if your credit score has dropped since your original purchase.

What costs should I expect when buying a home?

Besides your down payment, expect closing costs, appraisal fees, and other charges. Your lender will provide a breakdown early in the process so you can plan your budget.

Find the Right Financial Professional For Your Project

Find a Financial Professional

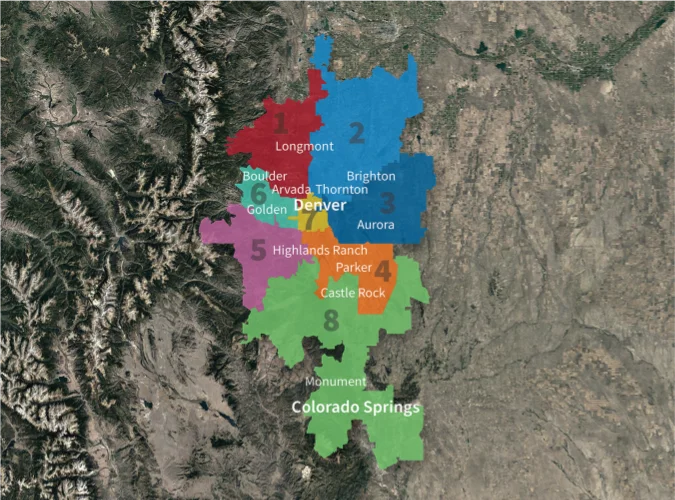

Proudly Serving the Colorado Front Range

With a reach that extends from Longmont to Colorado Springs, our ability to connect homeowners with renovation and repair professionals is unrivaled.

Zone 1: Boulder | Broomfield | Westminster | Arvada

Zone 2: Thornton | Brighton

Zone 3: Aurora

Zone 4: Parker | Castle Rock

Zone 5: Highlands Ranch | Littleton

Zone 6: Golden | Lakewood | Wheat Ridge

Zone 7: Denver

Zone 8: Monument | Colorado Springs

** We encourage you to check with state and local governments to see if your project requires any licenses and/or permits.

TOP